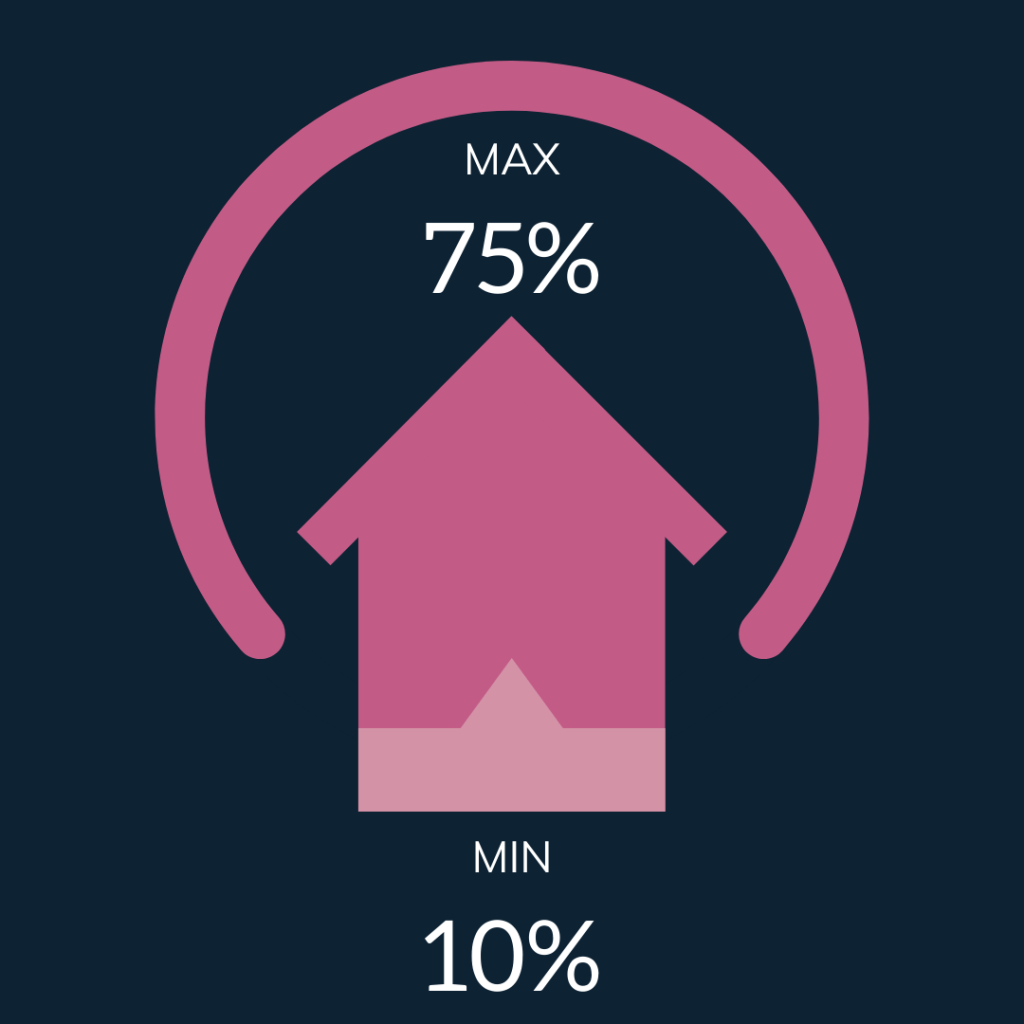

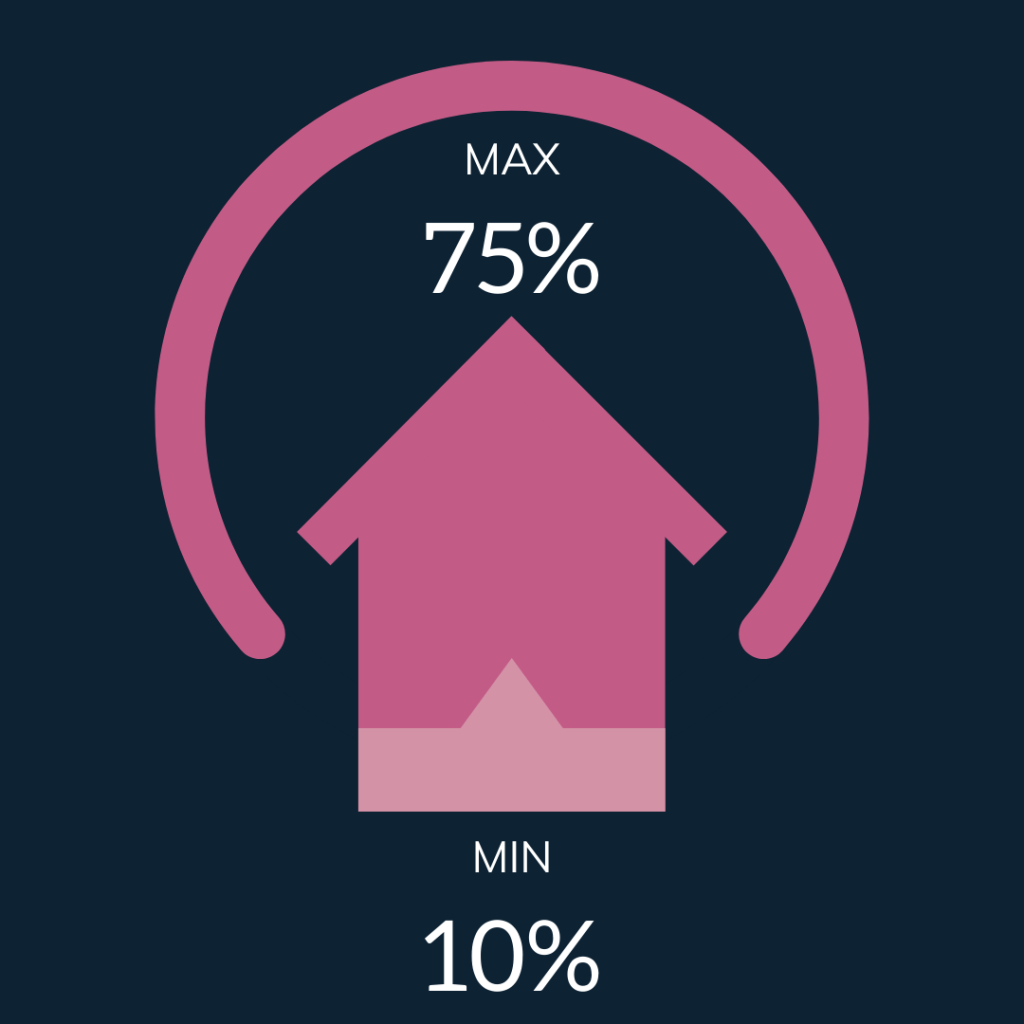

Buying a home through a shared ownership scheme works in the same way as buying a traditional property. The difference is that you will only finance part of the value yourself. We will own the remainder. We then rent this part to you at a subsidised rent.

As per guidelines from Homes England (our regulator), you will be encouraged to buy as much of the property as you can comfortably afford. Some schemes may have a minimum share higher than 10% in place.

Once you’ve signed on the dotted line you will be responsible for repairs and maintenance of your new home just like a home owner. As part of the leasehold agreement you will also be required to pay service charges to cover maintenance of communal areas, depending on the type of property you select.

Can I choose my own house?

Yes, to some extent. If you wish to proceed, you’ll need to choose from our available properties. You will be able to add three to your application and we’ll do everything we can to offer you one of these.

Can I keep pets in my home?

As a responsible landlord, Coastline allows most customers to keep common pets, such as dogs, cats, birds, small mammals, reptiles, and fish. However, some animals, including livestock, dangerous animals, and banned dog breeds, are not permitted. All pets must be well cared for and must not cause a nuisance or be left to create a mess or disturbance in your home or local community. Written permission may be needed if you wish to have more than one pet, or to keep types not already permitted.

Assistance Dogs are not classed as pets, but supporting evidence will be required. If pets cause problems, such as noise, damage, or anti-social behaviour, permission may be withdrawn and tenancy action may follow. A full copy of Coastline’s Pet Policy, including all rules and responsibilities, will be provided with your lease. If you have any questions regarding our pet policy, then please speak to a member of the team.

You will never be ‘allocated’ a house. If you don’t feel there is anything that meets your needs, you’ll be added to a register to wait until something appropriate comes along.

After all, different people like different houses. We would never expect you to buy a house you don’t fall in love with.

Does shared ownership make a house purchase cheaper?

Yes and no. Shared ownership is designed to make home ownership more accessible, rather than to discount the value of the home itself.

You buy a share of the property at its open market value, as assessed by an independent valuer. There is no reduction to the price of the share you purchase.

The advantage of shared ownership is that, by buying a share and paying rent on the remainder, the overall monthly cost is often similar to, or lower than, renting a comparable home. This can give you the opportunity to secure a home and start building equity sooner than continuing to rent.

As a shared owner, you benefit from any increase in the value of the share over time. As with all forms of home ownership, property values can go down as well as up, which means the value of your share could also change.